I heard it at the beauty shop first. Leader staffers gather news tips from lots of places and in lots of ways.

At governmental meetings, board members might do or say something newsworthy, and if that fails, there’s always what you hear in the hallway or on the parking lot.

Letters to the editor sometimes tell a secret or highlight an issue, and emails and phone calls can do the same.

Documents tell tales – court reports, board meeting minutes, community newsletters.

And then there’s the beauty shop. Mine is a hotbed of rumors about new business coming to town. While there’s an occasional dud, most of the rumors rise to truth.

Long ago, while getting my monthly hair upgrade, I heard buzz about a new hotel coming to Festus (a Hampton Inn, maybe?).

A reporter checked continually with the city of Festus, and after a year of pestering, the news was confirmed. A Hampton Inn was coming, all right, tied to a generous tax-abatement deal.

We’re not talking pennies. Well, we could be, but the deal requires 150 million of them.

The project is being financed through issuance of Chapter 100 industrial revenue bonds, authorized by the Festus City Council. The developer, Festus Hospitality LLC Property, can skip paying real estate taxes on improvements to the land – in other words, the hotel, itself – for a decade, although personal property on furnishings will still be owed.

The real estate abatement, plus a sales tax break on construction materials, will shave off about $1.5 million (as noted, thatza lotta pennies) from the estimated $4 million to build the four-story, 94-room hotel on 50 acres near the new KFC restaurant in south Festus.

Savings for the builder, however, comes at a cost to government coffers, and by extrapolation, to other taxpayers, who must shoulder more burden.

The Festus R-6 School District, which will miss out on close to $1 million in tax money over the 10 years, takes the biggest hit, but every government entity that collects a real estate property tax will have to practice patience while waiting for the new tax revenue to finally, finally land.

While the officials quoted in our story said they were OK with that, because of the overall positive effects of development, others disagree.

For example, 115 commenters on the Leader’s Facebook page.

We posted the Hampton Inn story to our website, with a link to Facebook and Twitter, as our weekly ICYMI (in case you missed it) feature. ICYHN (in case you haven’t noticed), social media is a place where people don’t mince words. And they didn’t in this case.

I recall one positive comment, from someone who anticipated an accompanying steak house, but otherwise, we were swimming in negativity.

To catch the mood, note that 10 of the comments were simply “angry” emoji faces.

So, to the 115, and to probably thousands of others who concur, I speak in defense of hotels and one of the best gifts they can bring a community – the tourism tax.

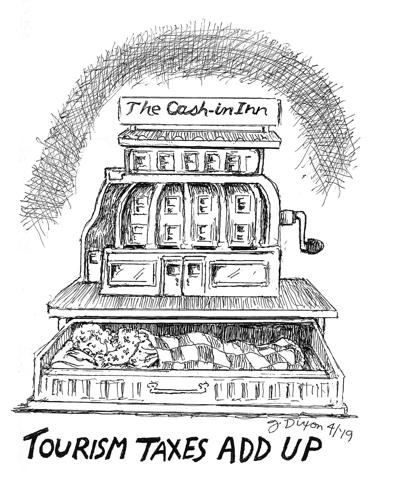

No one likes taxes – unless it’s a tax others have to pay, yet you reap the benefits. That, people, is the Tourism Tax to a T.

Visitors to your town pay the tax to rent a bed, and then the hotel turns the money over to a group of your neighbors, who will spend it to boost tourism, which in turn should boost your local economy.

It’s another case of pennies really adding up.

Both Arnold and Festus have four hotels and both have had a tourism tax for more than 15 years.

Festus collects a 5 percent tax – upped by voters in 2012 from the original 2 percent tax approved in 2002. To date, the city has collected $1,721,776.

Arnold also collects a 5 percent tax, approved in 2003. The city has received nearly $3 million since 2007, the farthest back tourism tax revenue can be tracked under the city’s financial system.

Pevely has just one hotel, but its 5 percent tax has still brought in $150,000 since 2013.

The money has to be spent on fun things – like concerts, festivals, sports tournaments and picnics, and promotion of said fun – not boring things like sewers and asphalt.

We don’t even have to feel guilty about fleecing out-of-towners because our local tax just returns the favor.

Wherever you travel outside our county, you have to pay a similar tax. My husband and I were charged $14.25 in “state hotel tax” for a $119 one-night stay in Cedar Rapids, Iowa, last weekend.

That comes to 12 percent, so compared to Iowa, Jefferson County, Mo., is more than twice as nice to our guests.

Should hotel developers keep getting honkin’ tax breaks to build bazillions of rooms for rent? If 10 years from now, our communities are swimming in commerce, driven partly by a thriving tourism industry, we’ll probably be OK with it.

But if those rooms are empty, and so is the tourism tax account, we’ll be looking for a red-faced emoji to express our dismay.

Our government officials are banking on the first scenario, and so is the optimist in me.

I heard a rumor today that another hotel is supposed to go in near the Hampton. No details.

That’s all right. I go back to the beauty shop next week.