The Crystal City Council and the Jefferson County Council have agreed to build roads to and from the James Hardie Industries plant.

The building materials manufacturer has proposed building a nearly $400 million manufacturing plant in Crystal City. Company officials have said the new facility will provide 238 jobs that pay an average of $34 per hour.

The Crystal City Council’s 7-0 vote on July 24 authorized Mayor Mike Osher to enter into an intergovernmental agreement with the county. Ward 1 Councilwoman Mary Schaumburg was absent.

The Jefferson County Council voted 6-0 on Aug. 14 to also enter into the agreement. Councilman Brian Haskins (District 1, High Ridge) was absent.

Crystal City attorney Brandon Moonier said the agreement was needed so the county can administer the money that will go toward the roads in Crystal City that will support the Hardie project.

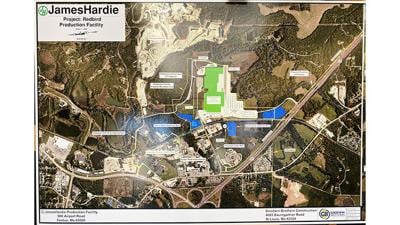

“The county has appropriated about $7.25 million from its ARPA (the federal American Rescue Plan Act stimulus program) to be utilized for the road work for Hardie,” Moonier said. “That road work includes an upgrade of Airport Road, rebuilding VFW Drive, connecting the plant to Calvary Church Road and then eventually connecting Calvary Church Road down to Castle Acres Road over a bridge down to the highway. So there’s a lot of work to be done here,” Moonier said.

He said the county used that $7.25 million in ARPA money as a match to attract a $7.281 million grant from the Governor’s Transportation Cost Share Program, which means the county has committed about $14.5 million for plant-related road projects.

“There’s no way it’s going to cover everything,” Moonier said. “But keep in mind the development agreement the city executed with the developer and the county caps the city’s obligation to that $14.5 million, as long as that (county) funding is still available, so it’s not like if it goes away, the city is on the hook for $14.5 million,” Moonier said.

According to MoDOT’s website, the Governor’s Transportation Cost Share Program provides financial assistance to public and private applicants for public road and bridge projects satisfying a transportation need. Under terms of the program, money granted will supplement, rather than completely pay for, road and bridge construction costs.

Moonier said that because the county is using its ARPA money and sponsored the application for the matching funds, the intergovernmental agreement is needed.

“The way that’s going to work is the county is basically playing the bank and the city will play project manager for the role of constructing those roadways,” he said.

He said the city would advertise and award bids for design and construction services and once work begins, it will provide the county with progress reports requesting payments.

County officials will review the reports to ensure compliance with the governor’s cost share program application and ARPA guidelines and, if approved, the county will transfer money to the city so it can pay the contractors.

Preliminary engineering work should wrap up sometime in September, according to city documents, with final plans due by April 2024. Construction bids are scheduled to be awarded in May 2024, with construction starting soon after and stretching through September 2025.

Hearing on tax abatement

The Crystal City Council likely will consider a proposal to allow tax abatement for the Hardie property at its regular meeting on Monday, Sept. 25.

“The developer is seeking Chapter 353 tax abatement through the state that would allow the plant to reduce its real estate taxes,” Moonier said. “The process is that the City Council must approve that the property is blighted.”

A public hearing on the proposed blighting and tax abatement and the preliminary development plan will be held at 6 p.m. before the council’s regular meeting.

“I expect that the council will vote on the blighting that night,” Moonier said.

He said he has not yet seen Hardie’s current proposal on tax abatement but expected it would be similar to the company’s previous proposal for a total real estate tax abatement for the first two years that the plant is open; 80 percent during years three and four and 50 percent for the next 16 years.

“That only covers real estate taxes,” Moonier said. “There is no proposal to abate property taxes, which considering the equipment that will be in this plant will be astronomical.”

Moonier said it’s typical for a developer of a project this size to ask for a property tax abatement.

The purpose of the hearing, he said, is to allow representatives of taxing districts that would be affected by the abatement to speak to council members.

“In advance of the meeting, they will be given impact statements so that there are no surprises,” he said.

Moonier said the council likely will decide on the preliminary development plan for the plant, which can be seen on the city’s website at crystalcitymo.org.