Jefferson County’s sales tax receipts were up for 2022 by 4.3 percent – a figure that is noteworthy, but not necessarily cause for celebration, County Executive Dennis Gannon said.

“It’s a good figure, now that I’ve reflected on it,” he said. “I am proud that since I took office, we haven’t had a down year yet, and 2022 continues that trend.”

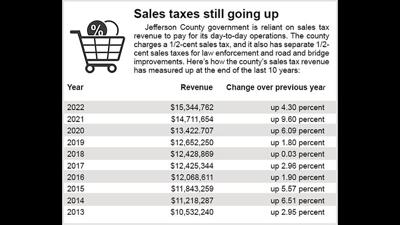

Sales tax revenue is important to the county because it finances most of its day-to-day operations through a 1/2-cent countywide tax on goods and services in lieu of charging property taxes.

Identical 1/2-cent sales taxes are collected for law enforcement and road and bridge improvements.

In addition, the county collects a 1/8-cent sales tax that goes toward a Community Children’s Services Fund.

The December disbursement from the state Department of Revenue, which reflects sales through mid-October, was for $1,371,598, bringing the 2022 haul to a record $15,344,762.

The 2022 year-end percentage increase wasn’t as robust as last year’s 9.6 percent, or even the increase of 6.09 percent during 2020, when many retailers, including restaurants, followed restrictions as a result of the coronavirus.

Since 1980, the only two years in which sales tax receipts were less than the prior 12-month period were 2008 (down .56 percent) and 2009 (down 5.76 percent). However, as recently as 2018, the increase was a microscopic .03 percent – that’s about a $3,500 increase over the year before.

“I’m just hoping that (for 2022) we’re not at a plateau of a six-year period that we’ll now start seeing less coming in,” Gannon said. “Still, 4.3 percent on top of 9.6 percent the year before – we’ll take that.”

But, Gannon said, sales tax revenue is unpredictable, which calls for a conservative approach to budgeting.

“I’m satisfied with modest growth, as long as it’s keeping up with inflation,” he said. “But it being up for the year won’t change how we approach budgeting.

“Take gasoline, for example. When we draw up the budget, we figure in the price at the going rate when we budget and try to look ahead to what the price may look like, which of course no one can predict. But I’m looking more at how many gallons we’re using. Are we using more gallons than we’re budgeting, or less? If it’s more than we budgeted for, why is that? I’d like to see our usage remain fairly consistent.”

Gannon said because it’s uncertain that this year’s increase was fueled more by increased consumer demand rather than higher prices, it’s another reason to stay conservative with spending.

“Inflation is certainly having some effect, but it’s difficult to determine to what extent,” he said. “Certainly, when I go to the supermarket with a shopping list in my hand and fill up the cart, I know that it’s costing more this year than the same cart of groceries cost last year. And I think it’s still safe to consider that online shopping, which was growing before COVID and got much bigger during that time, is cutting into our sales tax revenue.”