Jefferson R-7 School District officials are asking Crystal City Council members to delay a decision on a tax abatement proposal for the $400 million James Hardie Industries manufacturing facility to be built on the former Festus Municipal Airport site in Crystal City.

The Crystal City Council is expected to vote on the tax abatement proposal during its Sept 25 meeting.

“We are requesting a delay in the decision so we can get more information, better information, about the proposal,” said David Haug, superintendent of the R-7 district, which stands to lose tax revenue if the abatement is approved.

The proposal offers a 20-year schedule calling for 100 percent real estate tax abatement for the first year the plant is in operation, 80 percent the second year and 50 percent for the next 18 years. There is no abatement requested for the plant’s personal property tax, which would include all machinery, equipment, vehicles, etc.

Hardie representatives estimate that it will take four to five years to build the plant, and during the construction, the property will be taxed at its current rate.

According to figures provided by Hardie representatives, the estimated amount of tax revenue the Jefferson R-7 School District would receive over 20 years without an abatement would be just more than $21.6 million. With the abatement, the estimate is for just more than $10 million.

An informational meeting about the tax abatement proposal was held Sept. 14 at Crystal City Hall. Representatives from Crystal City, James Hardie, the county government and both the Jefferson R-7 and Crystal City school districts attended.

Haug said the R-7 district has not been in the loop about the Hardie plans, although the proposed plant lies entirely within the school district boundaries.

“We received notice of the (Sept. 14) meeting in a letter delivered to us on Sept. 11,” Haug said. “A certified packet with the proposal itself arrived at our school’s central office on that morning, the 14th.

“We’ve not been brought in on anything. We have no say in the process and have been asked for no input. This plant could be a good thing for the county, but it will have a dramatic effect on our district. We just feel like we should have a place at the table.”

Crystal City Administrator Jason Eisenbeis said the city is more than willing to include R-7 officials in discussions.

“Even though it wasn’t required by law, we had this informal meeting so we could sit down and talk about some of these things in depth,” he said. “And we’re certainly willing to meet with them again. They are the largest taxing entity affected by the project.”

Haug said the R-7 district needs more time “to review the language in the agreement.

“We have some concerns,” he added.

Among those concerns are the following:

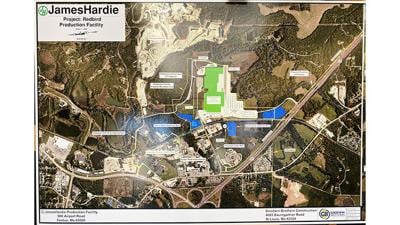

■ The master plan for the manufacturing facility includes extensive road construction and modification to routes used by school district buses as well as local drivers.

“The plan calls for plant traffic to be routed south to Exit 170, which is already a major safety concern for our district,” Haug said. “With the current MoDOT plans (to widen) I-55, it could be a huge problem for us.”

Eisenbeis said the plan sends plant traffic by several routes.

“It’s always been raw materials in on the north end of the site, employee traffic in on Airport Road and finished product out by the south end,” he said. “Hardie is very safety oriented. They have said from day one they won’t put truck traffic in front of the hospital.”

■ The proposal allows for eliminating the abatement for emergency service agencies, such as ambulance districts. R-7 officials contend that, by design and function, the school district could qualify as an emergency service provider and therefore be made exempt from the abatement.

■ The proposal also includes a provision for the developer to make annual PILOT (payment in lieu of taxes) payments to the Crystal City School District, although no part of the project is inside that school district’s borders.

“The statute says the collector shall allocate tax funds only to tax entities affected,” Haug said. “We are the only school district the plant would directly affect, so this could be in conflict with the statute.”

Eisenbeis said the terminology in the proposal mischaracterizes the payments.

“It’s actually a non-negotiated charitable contribution,” he said. “Back when we started negotiating with Hardie, we decided the city was taking the brunt of this, so what are we going to get out of it? We could have made (the contribution) for the fire department, for parks, the library – but we chose to make it for the school.”

Eisenbeis said he believes the Crystal City Council will likely vote on the proposal on Sept. 25.

“The council will decide on that day whether to move forward or put it on pause, based on input from all the taxing entities and the public,” he said. “At this point, I don’t have any reason to believe they won’t move forward.”

Haug said his district is simply asking for time to get a clearer understanding about aspects of the project that have the most impact on R-7.

“We aren’t passing judgment on anything; we just want clarification,” he said. “The people in our community have no say in this, no vote, and yet it’s their property values, their safety and most importantly, the futures of their children who are involved. It’s our job to help them understand how it’s going to affect us and to advocate for our kids.”